PM Awas Yojana: Complete Application Process Guide (Step-by-Step)

Housing is one of the most basic human needs, yet for millions of families in India, owning a permanent home has long remained a distant dream. To address this challenge and ensure “Housing for All,” the Government of India launched Pradhan Mantri Awas Yojana (PMAY). This flagship housing scheme aims to provide affordable housing to economically weaker sections, low-income groups, and middle-income families across urban and rural India.

If you are planning to apply for PM Awas Yojana but are confused about eligibility, documents, benefits, or the application process, this detailed guide will help you understand everything clearly—from start to finish.

What Is Pradhan Mantri Awas Yojana (PMAY)?

Pradhan Mantri Awas Yojana (PMAY) is a central government initiative launched in 2015 with the goal of providing pucca houses with basic amenities to eligible Indian citizens.

The scheme focuses on:

-

Affordable housing

-

Financial assistance through subsidies

-

Inclusive development for urban and rural populations

PMAY is divided into two major components:

-

PMAY-Urban (PMAY-U)

-

PMAY-Gramin (PMAY-G)

Each component targets a specific population group with tailored benefits and application procedures.

Objectives of PM Awas Yojana

The key objectives of PMAY include:

-

Providing affordable housing to poor and middle-income families

-

Improving living conditions in slums

-

Encouraging women empowerment through property ownership

-

Promoting eco-friendly and sustainable construction

-

Offering interest subsidies on home loans

-

Reducing homelessness in urban and rural areas

The broader vision is aligned with the government’s mission of “Housing for All”.

Types of PM Awas Yojana Schemes

1. PMAY-Urban (PMAY-U)

PMAY-Urban is designed for people living in cities and towns. It focuses on improving urban housing through four verticals:

a) In-Situ Slum Redevelopment (ISSR)

-

Redevelopment of slums using land as a resource

-

Beneficiaries receive pucca houses at the same location

b) Credit Linked Subsidy Scheme (CLSS)

-

Interest subsidy on home loans

-

Available for EWS, LIG, MIG-I, and MIG-II categories

c) Affordable Housing in Partnership (AHP)

-

Affordable housing projects in collaboration with public and private sectors

d) Beneficiary-Led Individual House Construction (BLC)

-

Financial assistance for individuals to construct or enhance their own houses

2. PMAY-Gramin (PMAY-G)

PMAY-Gramin focuses on rural households that:

-

Do not own a pucca house

-

Live in kutcha or dilapidated houses

Eligible beneficiaries receive direct financial assistance to build a permanent house with basic facilities such as electricity, sanitation, and drinking water.

Key Benefits of PM Awas Yojana

Some of the major benefits of PMAY include:

-

Interest subsidy up to ₹2.67 lakh under CLSS

-

Financial assistance up to ₹2.5 lakh for house construction (varies by area)

-

Mandatory or preferred female ownership or co-ownership

-

Houses equipped with toilets, electricity, LPG connection, and water supply

-

Transparent Direct Benefit Transfer (DBT) system

-

Support for eco-friendly and disaster-resistant construction

PM Awas Yojana Eligibility Criteria

Eligibility varies depending on whether you are applying under PMAY-Urban or PMAY-Gramin.

General Eligibility Conditions

-

Applicant must be an Indian citizen

-

Applicant or family must not own a pucca house anywhere in India

-

Applicant must not have availed housing benefits from any other government scheme

-

Family includes husband, wife, and unmarried children

Income Categories Under PMAY-Urban

| Category | Annual Household Income |

|---|---|

| EWS (Economically Weaker Section) | Up to ₹3 lakh |

| LIG (Low Income Group) | ₹3–6 lakh |

| MIG-I | ₹6–12 lakh |

| MIG-II | ₹12–18 lakh |

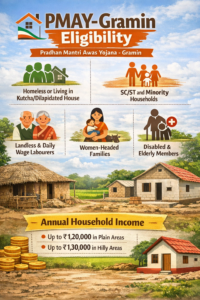

PMAY-Gramin Eligibility

Eligibility is based on:

-

Socio-Economic and Caste Census (SECC) data

-

Housing deprivation parameters

-

Priority given to SC/ST, minorities, widows, disabled persons, and senior citizens

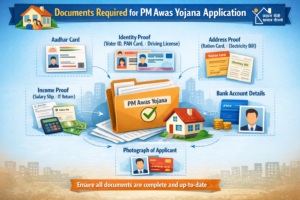

Documents Required for PM Awas Yojana Application

Before applying, keep the following documents ready:

-

Aadhaar Card

-

Identity proof (Voter ID / PAN / Driving License)

-

Address proof

-

Income certificate

-

Bank account details

-

Passport-size photographs

-

Property documents (if applicable)

-

Affidavit stating non-ownership of a pucca house

For PMAY-G, additional documents may be required by the Gram Panchayat.

PM Awas Yojana Application Process (Step-by-Step)

How to Apply for PMAY-Urban (Online Process)

Step 1: Visit the Official Website

Go to the official PMAY-Urban portal:

https://pmaymis.gov.in

Step 2: Choose the Relevant Option

Click on “Citizen Assessment” and select:

-

“For Slum Dwellers” or

-

“Benefits under other 3 components”

Step 3: Enter Aadhaar Details

-

Enter your Aadhaar number

-

Verify using OTP

Step 4: Fill the Application Form

Provide details such as:

-

Personal information

-

Income details

-

Family details

-

Housing requirement

-

Bank account details

Step 5: Upload Documents

Upload scanned copies of required documents.

Step 6: Submit the Application

After verifying all details, submit the form and note the application reference number for future tracking.

How to Apply for PMAY-Urban (Offline Process)

You can also apply offline by:

-

Visiting a Common Service Centre (CSC)

-

Paying a nominal fee

-

Submitting documents and biometric verification

How to Apply for PMAY-Gramin

PMAY-G applications are not accepted online directly by individuals.

The process involves:

-

Identification of beneficiaries using SECC data

-

Verification by Gram Sabha

-

Approval by local authorities

-

Direct transfer of funds to beneficiary’s bank account

If eligible, your name will appear in the PMAY-G beneficiary list.

How to Check PMAY Application Status

Online Status Check (PMAY-Urban)

-

Visit pmaymis.gov.in

-

Click on “Search Beneficiary”

-

Select “Search by Name, Father’s Name & Mobile Number”

-

Enter required details

You can also check status using your assessment ID.

PMAY-Gramin Beneficiary List Check

-

Visit https://pmayg.nic.in

-

Click on “Stakeholders”

-

Select “IAY/PMAYG Beneficiary”

-

Enter details such as state, district, and block

PMAY Credit Linked Subsidy Scheme (CLSS) Explained

Under CLSS, beneficiaries can get interest subsidies on home loans:

| Category | Interest Subsidy | Loan Amount |

|---|---|---|

| EWS/LIG | 6.5% | Up to ₹6 lakh |

| MIG-I | 4% | Up to ₹9 lakh |

| MIG-II | 3% | Up to ₹12 lakh |

The subsidy is credited directly to the loan account, reducing EMIs.

Common Reasons for PMAY Application Rejection

Some common reasons include:

-

Incorrect or false information

-

Income exceeding eligibility limits

-

Ownership of a pucca house

-

Aadhaar mismatch

-

Duplicate applications

Always double-check details before submission.

Tips to Increase Chances of Approval

-

Ensure Aadhaar and bank details are accurate

-

Apply under the correct income category

-

Prefer female ownership or co-ownership

-

Keep all documents updated

-

Track application status regularly

PM Awas Yojana: Challenges and Limitations

While PMAY has helped millions, some challenges remain:

-

Delays in construction

-

Land availability issues in urban areas

-

Awareness gaps in rural regions

-

State-level implementation differences

Despite these challenges, PMAY remains one of India’s most impactful social welfare schemes.

Conclusion

Pradhan Mantri Awas Yojana is a transformative initiative that has changed the lives of millions by turning the dream of home ownership into reality. Whether you live in a city or a village, PMAY offers a structured, transparent, and financially supportive path to owning a house.

By understanding the eligibility criteria, benefits, and application process clearly, you can avoid mistakes and increase your chances of approval. If you or your family meet the criteria, applying for PM Awas Yojana can be a crucial step toward a secure and dignified life.